- What is Mean By fintech?

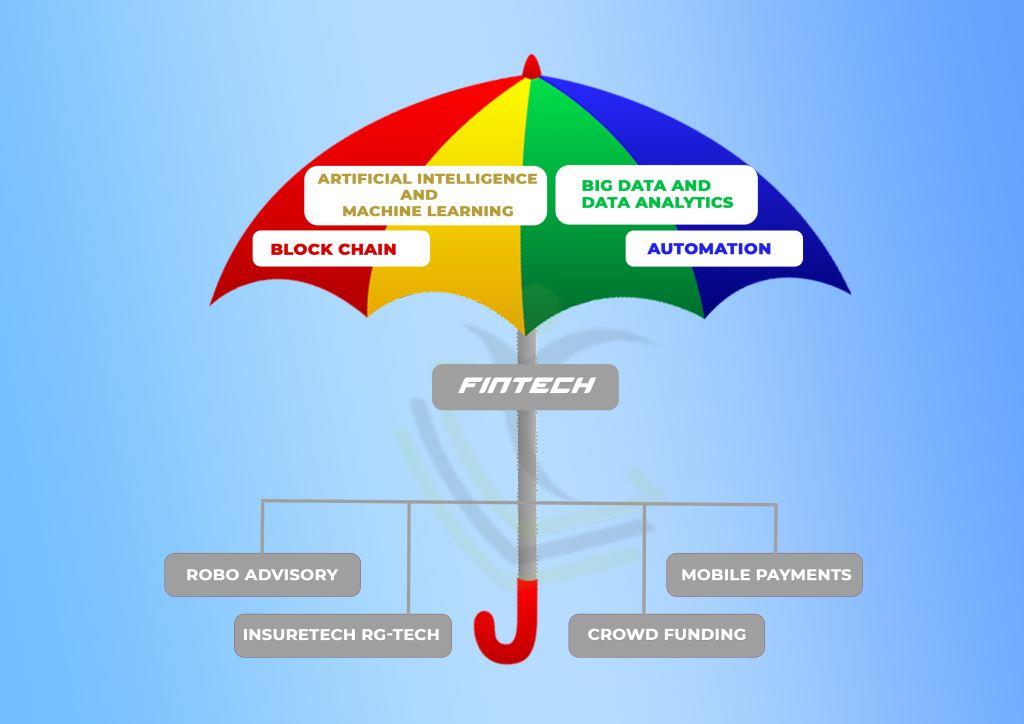

Definition – Fin-tech is a term used to depict new innovation that computerizes and works on the conveyance of financial administrations. - Fintech is an Umbrella term that covers technology-based companies operating in insurance, payment, asset management, etc.

- Fin-tech in the banking and monetary area ordinarily offer their administrations as products, applications, business cycles, and plans of action. The significant objective regions for fintech in this area are from the buyer and business loaning and installments space

- Fin-Tech is what’s to come??

As Fintech has changed the financial business by offering brilliant types of assistance, better client networks, and worth-added administrations; Fintech is administering the world and monetary area and take on the advancements which are changing the monetary area. - Fin-Tech is reconsidering the whole financial space, with banks moving to digitization. FinTech has moved forward making them paperless, presence less, and credit only.

- At the present, all banks are working in a totally computerized climate.

- Notable Fin-Tech Companies

- Personal Capital

- Lending Club

- Kabbage

- Wealthfront

- A fin-Tech is a vessel of Modern technology that can be portrayed as an arising modern help area of the 21st century.

- The fin-Tech firms have not totally quieted the customary banks at this point, as these organizations are as yet in the beginning phases of making a benchmark.

- Computerized Lending and Credit. FinTech merchants store private venture advances and are controlled by value-based information to help settle on staggeringly speedy loaning choices.

- Instances/Examples of Fin-Tech

- Mobile Banking

- Insurance

- Mobile Payments

- Trading

- Cryptocurrency & Blockchain

- Envestnet | Yodlee & FinTech

Essentially, fin-Tech has made our lives simpler and saved a great deal of time.